Investment Companies - Guardian Group

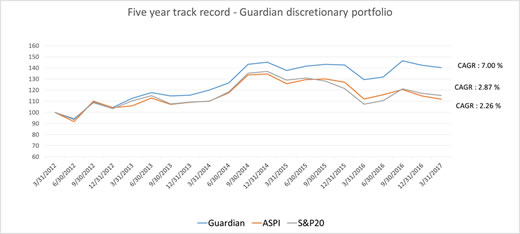

Guardian Group holds an investment portfolio worth approximately Rs. 18.40 billion as at the end of March 2017. This portfolio comprises equity stakes in some of Sri Lanka's most successfully run, listed, blue chip companies that have been built up for future value creation; as well as an actively traded portfolio to capitalize on short term market movements. We have three companies listed on the Colombo Stock Exchange (CSE). Of these, Ceylon Guardian Investment Trust PLC (GUAR) is positioned as the main holding company of the investment sector, engaged in listed and private equity, asset management and mutual funds management. Ceylon Investments PLC (CINV) is a listed equity investment company and Guardian Capital Partners PLC is a specialized private equity company. The asset management companies are unlisted.The financial year ending March 2017 saw the Guardian discretionary portfolio recording a 9.10% compared to the benchmark All Share Price Index of -0.16%.

The market capitalisation of Ceylon Guardian Investment Trust PLC, Ceylon Investment PLC and Guardian Capital Partners PLC stood at Rs. 18.4 billion, Rs. 8.7 billion and Rs. 0.71billion respectively.

Guardian Fund Management Limited

Guardian Fund Management Limited is a specialized fund management company within the Group responsible for managing the portfolios of the investment companies of the Group. This company has capabilities in portfolio management and research coupled with management processes to ensure good governance and risk management. Further, the company will widen its expertise in venture capital investments, investment banking services and overseas investments in time to come. Guardian Fund Management obtained registration as an Investment Manager with the Securities and Exchange Commission of Sri Lanka in April 2006.The fund management company currently has approximately Rs. 3.9 billion (USD 25.5 million) of institutional client funds. Together, the total discretionary portfolios, excluding strategic investments, managed by the company amount to Rs. 16.98 billion (USD 111 million).

Ceylon Guardian group discretionary equity portfolio managed by the company recorded performances as given below:

The Sri Lanka Fund (www.thesrilankafund.com)

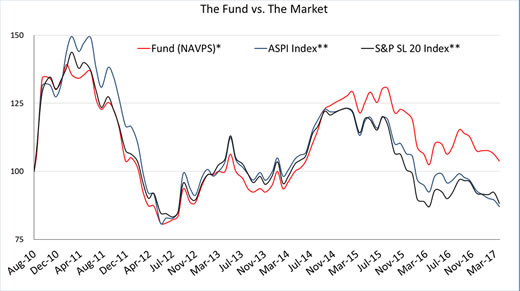

In recognition of Carson's fund management capabilities, its subsidiary Guardian Fund Management Limited was appointed manager of the Sri Lanka Fund (formerly known as the Regent Sri Lanka Fund). The Sri Lanka Fund, which was incorporated in the Cayman Islands, is the only dedicated country fund to invest in the Colombo Stock Exchange. Its Net Asset Value as at 28 March 2017 was US$ 0.82. The Fund caters to both retail and institutional investors worldwide who are focused on emerging markets.The fund size currently amounts to US$ 2.40 Million, mainly consisting of promoter's seed capital.

The performance of the Sri Lanka Fund is given below:

| Period | Fund | ASPI* | S&P SL20 | |

| 1 Month | -2.38% | -2.72% | -4.37% | |

| 3 Months | -3.53% | -4.96% | -3.71% | |

| YTD 2017 | -3.53% | -4.96% | -3.71% | |

| Since Relaunch | 3.80% | -12.93% | -11.72% | |

| 2014 | 33.33 | 23.01 | 24.90 | |

| 2015 | -6.00% | -13.97% | -19.28% | |

| 2016 | -9.57% | -13.26% | -7.54% |

Guardian Acuity Asset Management Limited (www.guardianacuity.com)

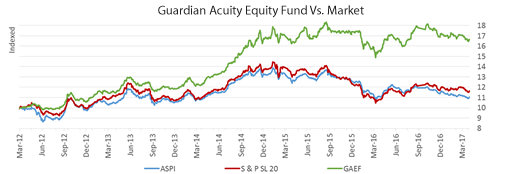

Guardian Acuity Asset Management Limited was formed on June 17th 2011 for the purpose of bringing together the expertise of the two joint venture partners, Ceylon Guardian Investment Trust PLC and Acuity Partners (PVT) Ltd to manage and market unit trusts. Acuity Partners, is the investment banking arm of two leading commercial banks – HNB and DFCC. Ceylon Guardian's management teams’ contribution to the venture comes through their fund management expertise, while Acuity brings in their partner network and reaches in marketing and distribution of financial products.The company is an authorised unit trust management company, accredited by the Securities and Exchange Commission of Sri Lanka, holding licenses for two unit trust funds - namely the Guardian Acuity Fixed Income Fund and the Guardian Acuity Equity Fund.

Fund performances are given below, against the benchmark.

Guardian Acuity Equity Fund

| GUARDIAN ACUITY EQUITY FUND PERFORMANCE (as of 31st- March-2017) | ||||

| Period | GAAM EQ Fund | All Share Index | S & P SL 20 | |

| March - 2017 | -2.10% | -1.18% | -2.96% | |

| 3 Months | -2.25% | -2.67% | -1.65% | |

| YTD 2015 | -2.25% | -2.67% | -1.65% | |

| Since Inception | 63.29% | 10.69% | 16.35% | |

| Since Inception - CAGR | 10.11% | 2.01% | 3.02% | |

Guardian Acuity Money Market Fund

| GUARDIAN ACUITY MONEY MARKET FUND PERFORMANCE (as of 31s-t March-2017) | ||||

| Period | GAFIF | NDBIB-CRISIL 91 Day T-Bill Index | Annualised Fund | |

| March - 2017 | 1.00% | 0.72% | 11.73% | |

| 3 Months | 2.86% | 2.02% | 11.61% | |

| YTD 2015 | 2.86% | 2.02% | 11.61% | |

| Since Inception | 62.33% | 50.54% | 12.24% | |

Guardian Acuity Money Market Gilt Fund

| GUARDIAN ACUITY MONEY MARKET GILT FUND PERFORMANCE (as of 31st- March-2017) | ||||

| Period | GAFIF | NDBIB-CRISIL 91 Day T-Bill Index | Annualised Fund | |

| March - 2017 | 0.78% | 0.72% | 9.21% | |

| 3 Months | 2.29% | 2.02% | 9.27% | |

| YTD 2015 | 2.29% | 2.02% | 9.27% | |

| Since Inception | 16.53% | 15.70% | 8.18% | |

Visit www.guardianacuity.com for more details